What Is Home Equity & How Do You Use It?

Looking for a way to fund your next home improvement project? Depending on your situation, you may be able to tap into your home equity for some assistance. Having extra financing options available is one way homeowners can benefit from building home equity.

Before undertaking your next big project, it can help to first understand exactly what home equity is and how it can be used to bankroll the work you need done. And after you calculate your current home equity, you can determine what your best home equity borrowing option would be.

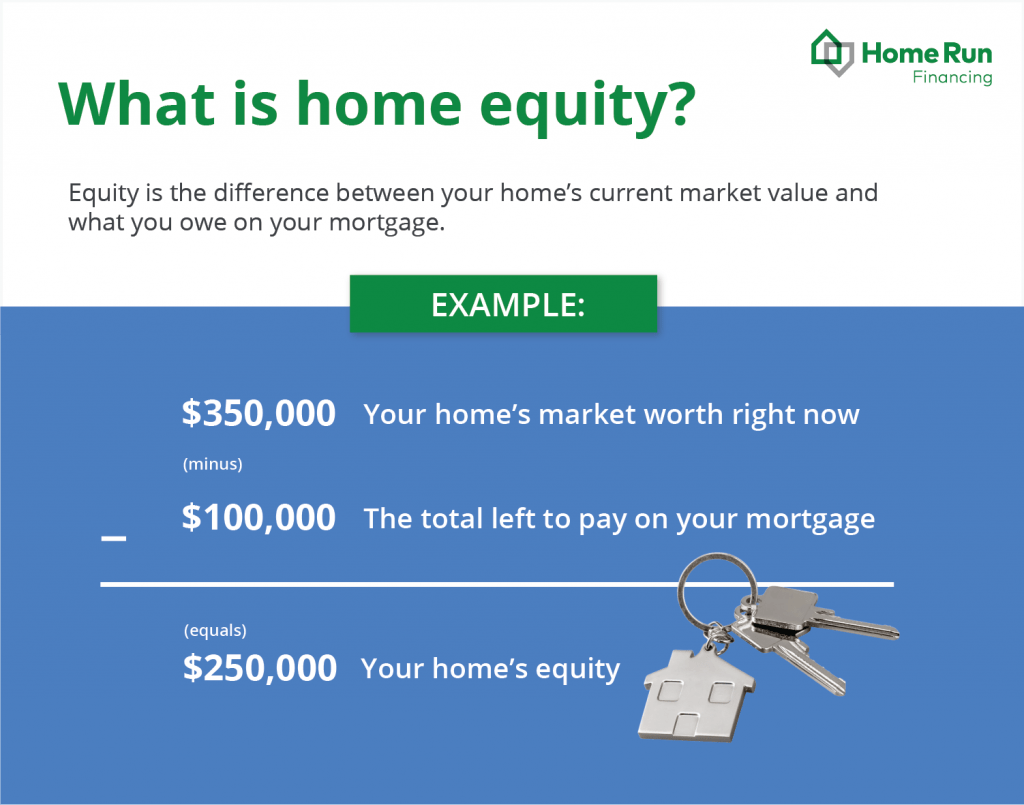

What is home equity?

Put simply, home equity is what your home is worth right now on the market minus the total left to pay on your mortgage. Here’s an example of home equity: If your home is worth $350,000, but you still owe $100,000 on your mortgage, your home’s equity would be $250,000.

Calculating your home equity

It’s worth noting that your home equity can change over time. For example, as you pay down your mortgage, the amount of equity in your home will increase. On the other hand, a drop in your home’s market value will cause your home equity to decrease. That’s why it’s useful to calculate your home’s equity on a regular basis.

In order to calculate your home equity, you’ll first need to know what your house is worth. If you’re unsure of the current value of your home, a real estate appraiser will be able to give you the most accurate valuation.

Once you have your home’s current appraised value, you can determine your home equity using the following formula:

Home’s Current Value — Balance Left on Mortgage = Your Home’s Equity

Using home equity for home improvements

So, how can you use your home equity? One of the more common uses of home equity is to finance home improvements. Improvement projects not only make your home look nicer but also add value to your property, in turn increasing your home equity.

You may decide to use your home equity for any number of home improvement projects, such as:

- Replacing an HVAC system

- Financing a roof replacement

- Installing solar panels

- Upgrading windows and doors

Comparing your home equity borrowing options

Once you’ve built your home equity up, you’ll have the ability to borrow money against it. Borrowing against your home equity is similar to using a personal loan or credit card to make a purchase. However, there will likely be some differences in the way the interest rates and repayment terms are structured.

When it comes to borrowing against your home equity, there are several options available to you. Taking the time to compare your different borrowing options can help ensure that you get the terms and conditions that are most favorable to you.

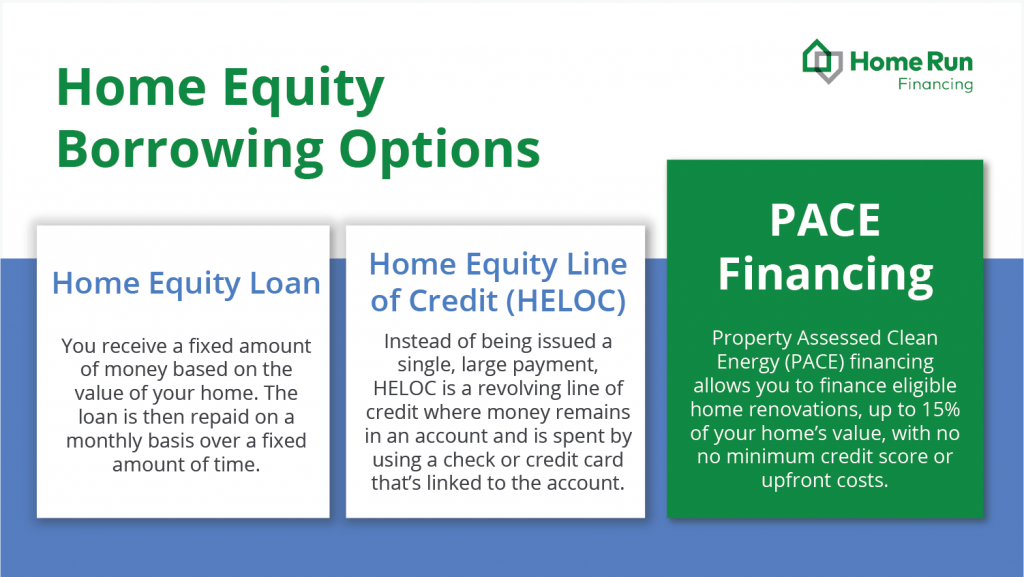

Taking out a home equity loan

One option for borrowing money against your home equity is to take out a home equity loan. With a home equity loan, you receive a fixed amount of money based on the value of your home. The loan is then repaid on a monthly basis over a fixed amount of time, similar to your mortgage payments. Generally, a home equity loan limits the amount you can borrow to no more than 85% of the equity in your home.

Home equity loan example: Let’s say you have $100,000 in home equity. This would likely qualify you for a home equity loan of $85,000, which should arrive as a single payment. You’d then be responsible for making monthly payments on the loan, along with interest, until the loan is paid off. If you’re unable to repay the loan as agreed, your lender has the right to foreclose on your home.

Who is eligible for home equity loans?

Although the exact requirements may vary depending on your lender, you should qualify for a home equity loan if you:

- Have sufficient equity in your home

- Have a history of making payments on time

- Have a low debt-to-income ratio

- Meet the credit score requirements

- Meet the income requirements

Borrowing against your equity with a HELOC

Another way to borrow against your home equity is through a home equity line of credit, popularly known as a HELOC. Much like credit cards, HELOCs are revolving lines of credit. So, instead of being issued a single, large payment, HELOC money remains in an account and is spent by using a check or credit card that’s linked to the account. Generally, the credit limit on your HELOC will be about 85% of the amount of equity in your home.

HELOC example: Say you have $50,000 built up in home equity. You may be able to qualify for a HELOC with a credit limit of $42,500. However, you’ll only be responsible for making payments on the amount you borrow and the associated interest, not the full amount available. As with home equity loans, HELOCs also require that your house be put up as collateral. This means your lender could foreclose on your house if you can’t keep up with the payments.

Who is eligible for a home equity line of credit?

The exact requirements will likely differ based on your lender, but in general, you should qualify for a home equity line of credit if you:

- Have sufficient equity in your home

- Have a good credit history

- Have a low debt-to-income ratio

- Have a history of making payments on time

- Meet the income and employment requirements

Paying costs back through a voluntary PACE assessment

Rather than using a home equity loan or HELOC to cover the cost of home improvement projects, you also have the option of using Property Assessed Clean Energy (PACE) financing. If you’re not sure what PACE financing is, it’s a program that allows you to finance eligible home renovations with no upfront costs or credit checks. You can borrow up to 15% of your home’s value and choose the term length that works best for you.

To give an example of how PACE financing works, say you’re looking to finance residential solar panels. If your application is approved, you’ll be eligible to get 100% of the project financed without making any down payments. What’s more, you may have up to 17 months until your first payment is due. Once you start paying, you’ll then be responsible for making monthly payments, with interest, until your balance is paid in full. Since the charges are added to your property tax payments, you’ll face the same penalties of not paying your property taxes if you’re unable to repay as agreed.

Who is eligible for this type of financing?

The eligibility requirements for PACE financing can be a bit different than for home equity loans and HELOCs. State and local requirements may vary, but in order to qualify for this type of financing, you’ll generally need to:

- Live in a PACE financing state and municipality

- Have the demonstrated ability to make the PACE assessment

- Have enough equity for the assessment amount

- Be current on property taxes

- Be current on mortgage debt

What to consider before borrowing against home equity

Before borrowing money against your home equity, there are a few important things to take into consideration. For example, some borrowing options feature fixed interest rates, while others will have you repay your interest at a variable rate. The way your interest rates are structured can have a big impact on how much money you’ll have to repay, so it’s worth looking into as you shop around.

You’ll also want to consider your current financial situation prior to borrowing against your home equity. As mentioned earlier, you could face foreclosure if you’re unable to repay the money you borrow, so it’s important to make sure you have sufficient income before applying.

When applying for a home equity loan or HELOC, you’ll also likely need to meet some credit requirements. If you’re concerned about your credit score harming your eligibility, consider Home Run Financing as a borrowing option. With no credit checks or upfront payments, this type of financing can help you get your home renovations underway quickly and easily.

The importance of home equity

For homeowners, there are many reasons why home equity is important. The money you borrow against your home equity can be used to pay for expensive home repairs, such as replacing your HVAC system or a new roof. Or you could use the funds to improve your home’s safety and/or energy efficiency, such as installing solar panels. What’s more, your interest rate will likely be lower than it would be with a personal loan.

When you work with Home Run Financing, you can get 100% of your home improvement project financed without any credit checks or down payments. You’re also able to choose the repayment term that works best for your budget. Plus, our approved contractors will ensure that your project is done quickly and correctly.

To see if your project and location are eligible, contact Home Run Financing today.